The pressure is finally getting to Facebook. Sort of.

The social-media giant missed analyst expectations slightly on its second-quarter earnings today, July 25, a slowdown its executives have warned about over the past year, for which it seems Wall Street was unprepared.

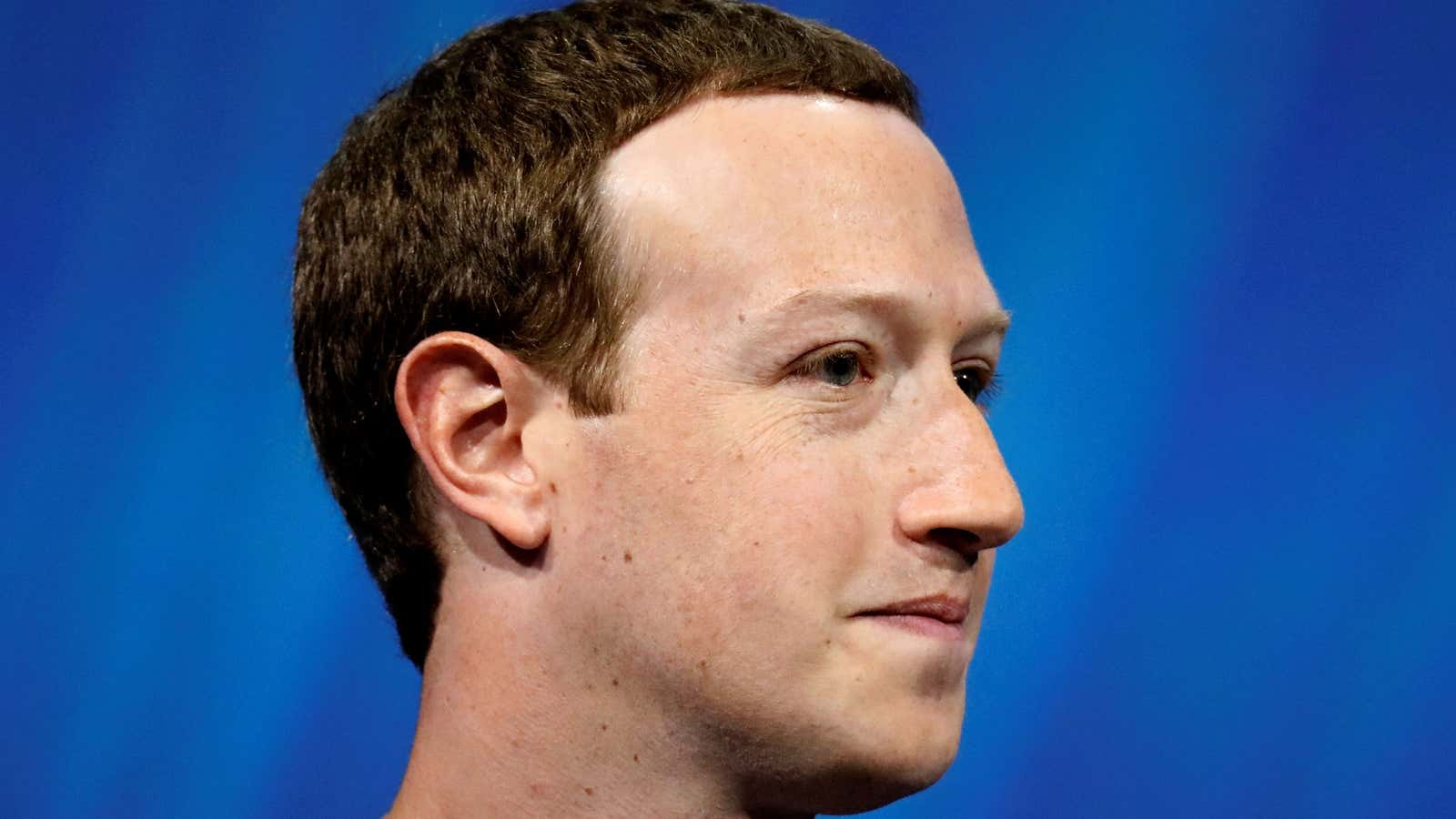

CEO Mark Zuckerberg has said on past earnings calls that the company would take a hit as it pours money into content moderation in a massive hiring effort to control the flow of bad posts—among other investments—and shifting the News Feed to interactions with friends and family, versus posts from brands and organizations.

The company’s stock plummeted in after-hours trading on today’s report, initially down by as much as 10% on the day’s close of $217.50.

In recent weeks, Facebook has faced increased scrutiny over its failure to eliminate misinformation and harmful content on its platform.

And during Facebook’s call with analysts, the company’s chief financial officer, David Wehner, indicated that Facebook’s privacy scandals, coupled with other “headwinds” it’s facing, would likely continue to have a “negative impact on revenue growth” in the coming quarters.

“We expect our revenue growth rates to decline by high-single-digit percentages from prior quarters sequentially in both Q3 and Q4,” Wehner added.

Wehner’s comments sent the stock price careening even further down, to roughly $170, or about 23% off the closing price, at the time of publishing.

Revenue growth has slowed down, although the company posted $13.2 billion for the quarter, a solid 42% increase over the same quarter last year.

For the first time in 11 quarters, Facebook missed analysts’ revenue expectations, which had it posting $13.3 billion for the quarter, according to analysts surveyed by FactSet. Mobile advertising revenue accounted for ever more of the company’s total revenue, growing from 87% in the same quarter last year to 91%.

Monthly users totaled 2.23 billion, slightly missing the 2.25 billion analysts had been expecting. “So far the fundamental damage to the Facebook platform has been ‘very contained’ in our opinion and is generally better than feared from the white knuckle period a few months ago,” Daniel Ives, an analyst at GBH Insights, wrote in a note to investors after the earnings posted, but before the call, referring to the Cambridge Analytica scandal. He called the quarter “respectable,” in contrast to Facebook’s past record-breaking results.

Likely in an effort to mitigate the misses on revenue and monthly users, Zuckerberg said on the earnings call that the company was sharing a new number: 2.5 billion. That’s the number of people who use at least one of Facebook’s apps, including its main app, WhatsApp, and Instagram.

He touted the acquisition of Instagram in 2012 as “an amazing success.” The app recently hit 1 billion monthly users.

Daily active users in the US, which continues to be Facebook’s most profitable market, remained stable, after falling for the first time ever in the last quarter of 2017. Three million fewer people logged onto Facebook in Europe this quarter, presumably because of General Data Protection Regulation (GDPR) new sweeping privacy law in the region, which made logging into Facebook a slightly more difficult task.